The Ultimate Guide To Ach Processing

Throughout the years, the globe of financial has actually changed significantly and also has actually worldwide influenced millions of individuals. During this age of growth, instead of making repayments by money, checks, debt or debit card, the settlement process has advanced into much faster, much safer as well as more reliable digital methods of transferring cash. Automated Clearing Up House (ACH) has actually made this possible.

Given that the very early 1970s, this U.S. monetary network permits organizations to move money without making use of paper checks, charge card networks, cable transfers or cash - locally and also worldwide. Greater than 25 billion ACH transactions are refined each year by the Automated Cleaning Residence Network consisting of a digital network of financial institutions and banks supporting both ACH credit as well as debit settlements in the U.S

There are two primary groups for which both consumers and services make use of an ACH transfer. Direct payments (ACH debit deals) Straight down payments (ACH credit history purchases) Some financial institutions likewise use costs settlement, which allows customers to schedule and pay all costs electronically utilizing ACH transfers. Or you can utilize the network to launch ACH purchases in between people or sellers abroad.

Usually, ACH transfers clear the financial institution in just a couple of business days unless there are insufficient funds in the account. Transactions can take longer under certain circumstancessuch as if the system identifies a possibly deceptive transaction. An ACH settlement is made by means of the ACH network, as opposed to going via the significant card networks like Visa or Mastercard. ach processing.

Some Known Facts About Ach Processing.

:max_bytes(150000):strip_icc()/how-ach-payments-work-315441-v2-5b4cb9f346e0fb005bd7eeae.png)

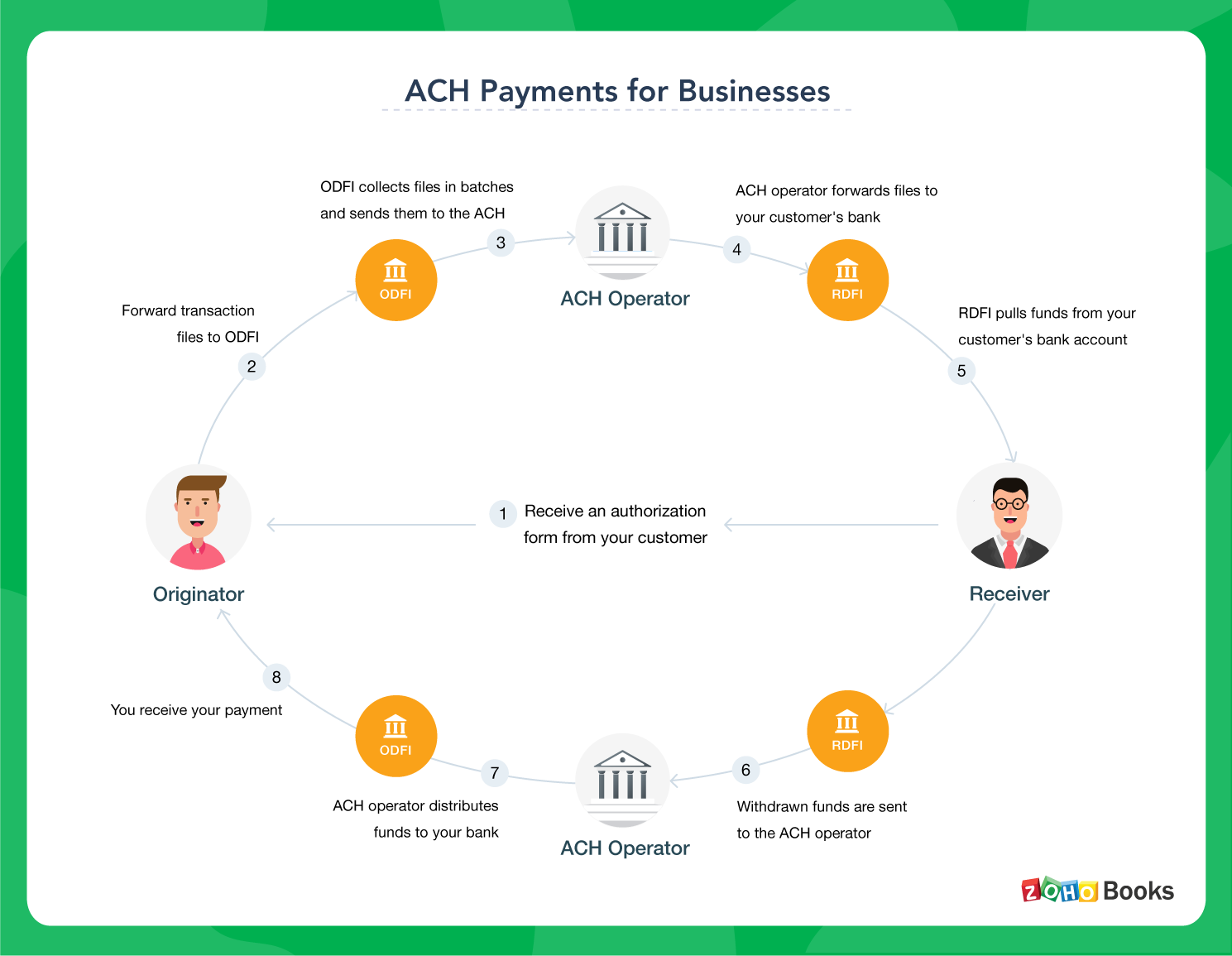

An ACH debit transaction does not entail physical paper checks or debit card. ach processing. The only details the payee requires is a savings account as well as routing number. To initiate a deal with ACH, you'll need to accredit your biller, such as your electric business, to pull funds from your account. This usually happens after you provide your financial institution account and also directing numbers for your bank account and offer your authorization by either literally or online authorizing an agreement with your biller.

You may enable an energy company to immediately charge your account for month-to-month bills. The biller launches the purchase, and also you do not have to take any activity. You can likewise establish up a web link between your biller as well as your savings account without authorizing automated payments. This offers you higher control of your account, permitting you to send payment funds just when you especially enable it.

It moves money from the employer's checking account to a worker's in a simple as well as fairly economical method. The company just asks their banks (or payroll business) to advise the ACH network to pull cash from their account and also deposit it as necessary. ACH down payments permit individuals to start down payments elsewherebe that a costs payment or a peer-to-peer transfer to a pal or proprietor.

An Unbiased View of Ach Processing

An ACH straight repayment provides funds right into a financial institution account as credit score. When you get payments via direct deposit with ACH, the advantages include ease, less charges, no paper checks, and much faster tax reimbursements.

Picture resource: The Balance The number of debit or ACH credit scores processed annually is progressively raising. In 2020, the ACH network refined monetary transactions worth even more than $61. 9 trillion, an increase of nearly 11 percent from the previous year. These included government, customer, and business-to-business purchases, as well as worldwide payments.

4% rise from 2020, as the click here for more pandemic fast-tracked services' switch to ACH settlements. Over simply the past 2 years, ACH B2B payments are up 33. An ACH credit scores involves ACH transfers where funds are pressed into a financial institution account.

When someone establishes up a payments through their bank or credit score union to pay expenses from their nominated financial institution account, these repayments would certainly be processed as ACH credit scores. ACH debit purchases entail ACH transfers where funds are pulled from a checking account. That is, the payer, or customer provides the payee permission to total payments from their nominated financial institution account whenever it becomes due.

Little Known Questions About Ach Processing.

ACH and credit score card settlements both enable you to take repeating payments merely and also conveniently. Nevertheless, there are three major differences that it may be beneficial to highlight: the warranty of settlement, automated cleaning house handling times, and costs. When it comes to ACH vs. charge card, one of the most vital distinction is the guarantee of settlement.

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)